Facts About Dubai Company Expert Services Uncovered

Wiki Article

All About Dubai Company Expert Services

Table of ContentsGetting My Dubai Company Expert Services To WorkThe Main Principles Of Dubai Company Expert Services Not known Details About Dubai Company Expert Services What Does Dubai Company Expert Services Mean?Everything about Dubai Company Expert Services

As the little young boy claimed when he left his initial roller-coaster ride, "I like the ups yet not the downs!" Right here are several of the risks you run if you intend to begin a little company: Financial danger. The economic resources required to start as well as expand an organization can be comprehensive.Time dedication. Individuals commonly begin organizations so that they'll have even more time to spend with their family members. Regrettably, running an organization is very taxing. In concept, you have the liberty to require time off, yet in truth, you might not have the ability to obtain away. In fact, you'll possibly have much less free time than you 'd have functioning for another person.

6 "The Business owner's Workweek" (Dubai Company Expert Services). Vacations will certainly be challenging to take as well as will frequently be interrupted. In current years, the difficulty of obtaining away from the job has actually been worsened by mobile phone, i, Phones, Internet-connected laptop computers as well as i, Pads, and several small company proprietors have actually concerned be sorry for that they're constantly obtainable.

Some people know from a very early age they were meant to possess their very own business. There are a number of advantages to beginning a company, but there are likewise takes the chance of that ought to be evaluated.

Dubai Company Expert Services Can Be Fun For Anyone

For others, it may be overcoming the unidentified and also striking out by themselves. Nonetheless you define personal satisfaction, beginning a brand-new firm might hold that assurance for you. Whether you check out beginning a business as an economic requirement or a way to make some added revenue, you may find it produces a new source of revenue.Have you evaluated the competitors as well as taken into consideration exactly how your specific company will prosper? Detail your business objectives. What do you wish to achieve as well as what will you consider a success? Another huge choice a local business proprietor deals with is whether to own the service directly (sole proprietorship) or to create a different, legal service entity.

An advantage firm is for those service proprietors who desire to make an earnings, while additionally serving a philanthropic or socially helpful mission. You can form your organization entity in any state however proprietors usually pick: the state where the company is situated, or a state with a preferred regulating law.

Ensure the name has words or abbreviations to show the entity kind. See to it it does not contain any forbidden or restricted words or expressions. The entity can be a different taxable entity, indicating it will certainly pay revenue tax obligations by itself income tax return. Dubai Company Expert Services. The entity can be a pass-through entity, suggesting the entity does not pay the tax obligations yet its revenue goes through to its owner(s).

All About Dubai Company Expert Services

Sole investors as well as partners in a collaboration pay around 20% to 45% income tax obligation while business pay firm tax obligation, commonly at 19%. As long as company tax prices are lower than earnings tax rates the benefit will certainly often be with a minimal firm. Along with salary repayments to staff members, a firm can likewise pay returns to its shareholders.Offered a minimum level of income is taken, the director retains privilege to specific State benefits without any type of employee or company National Insurance Contributions being payable. The balance of remuneration is occasionally taken as rewards, which might suffer less tax than income and also which are not themselves based on National Insurance coverage Contributions.

This may be beneficial when the withdrawal of more income this year would certainly go to website take you right into a greater tax bracket. You should constantly take professional tax or monetary guidance in the light of your specific situations, and also this location is no exemption. No recommendations is used right here.

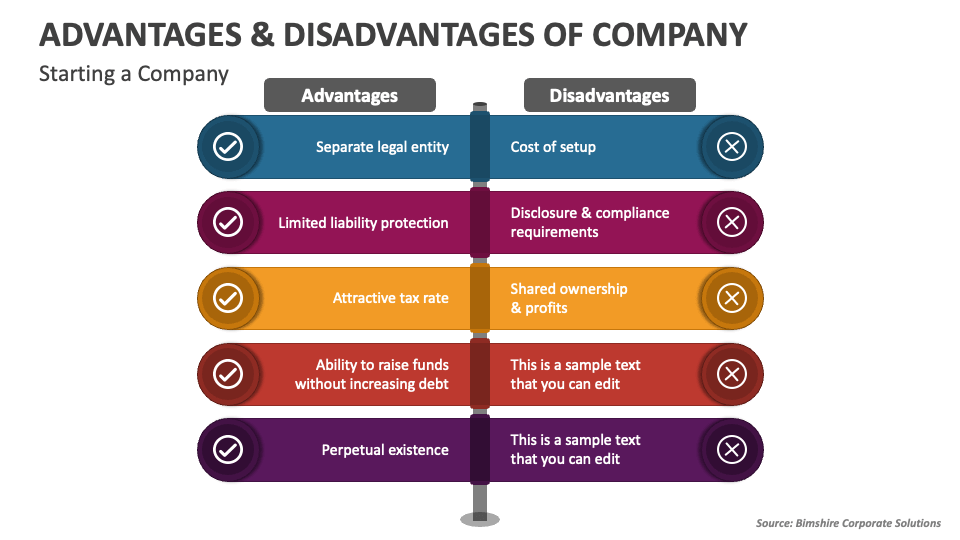

The most common kinds of corporations are C-corps (double tired) and also S-corps (not double tired). Benefits of a company include personal liability defense, organization safety and also connection, as well as simpler access to capital. Drawbacks of a firm include it being time-consuming and also based on dual tax, as well as having rigid procedures and also methods to follow.

Things about Dubai Company Expert Services

One option is to framework as a company. There are several factors why integrating can be advantageous to your service, there are a few negative aspects to be conscious of. To help you determine if a firm is the best lawful structure for your business, we talked with legal specialists to damage down the different kinds of corporations, and also the advantages as well as drawbacks of incorporating.For many organizations, these demands include developing business bylaws and declaring short articles of unification with the secretary of state. Preparing all the info to submit your posts of incorporation can take weeks and even months, but as quickly as you have actually effectively submitted them with your secretary of state, your service is formally acknowledged as a corporation.

Companies are normally controlled by a board of supervisors chosen by the investors."Each investor typically gets one vote per share in electing the directors," said Almes. "The board of directors supervises the monitoring of the day-to-day procedures of the firm, and also often do so by hiring check this a management team."Each owner of the corporation generally owns a percentage of the business based upon the variety of shares they hold.

A corporation offers extra individual property liability security to its owners than any type of various other entity type. For instance, if a company is filed a claim against, the investors are not personally liable for company financial obligations or lawful obligations even if the firm doesn't have sufficient cash in possessions for payment. Personal liability security is among the major reasons businesses choose to incorporate.

Dubai Company Expert Services Fundamentals Explained

This accessibility to funding is a luxury that various other entity kinds do not have. It is terrific not just for growing an organization, yet additionally for saving a company from going bankrupt in times of demand. Although some firms (C companies) are subject to dual taxation, other firm structures (S firms) have tax advantages, depending on how their income is distributed.Any revenue assigned as owner salary will go through self-employment tax obligation, whereas the rest of the business rewards will certainly be tired at its own degree (no self-employment tax obligation). A company is except everybody, as well as it could end up costing you more time as well as cash than it deserves. Prior to ending up being a company, you should be mindful of these possible disadvantages: There is a lengthy application process, you should follow inflexible rules and also methods, it can be costly, and you may be dual taxed (depending read what he said upon your firm structure).

There are numerous types of corporations, including C companies, S corporations, B corporations, closed companies and also not-for-profit companies. Some alternatives to companies are single proprietorships, partnerships, LLCs as well as cooperatives. (C-corp) can have a limitless number of investors as well as is taxed on its income as a different entity.

Report this wiki page